Product

Solutions

Resources

Welcome to the November edition of the Weelhouse Wire, your monthly download from Weel HQ.

As the year wraps up, several themes have dominated our conversations with finance teams across ANZ: economic conditions remain tight, fraud is getting smarter, and AI is quietly moving into the core of day-to-day finance workflows. In this edition, we'll focus on how finance leaders are adapting.

Here's what's inside:

Found this newsletter helpful? Forward it to a teammate and share the insights.

These stories sparked conversation at Weel HQ, so we’re passing them on to you.

We were pleased to host a group of CFOs and senior finance leaders at our latest CFO Roundtable last week. Damon Hauenstein, Weel’s CFO/COO, led an engaging lunch discussion at Sydney’s Rockpool with leaders from NIDA, Oz Hair & Beauty, Uniting Church Assembly, Squeeze Group, Marist180, Purpose Accounting and InSpace.

The conversation ranged from the pace of automation to the increased expectations on finance teams, with discussion also touching on how leaders are strengthening their controls as fraud threats evolve. Across very different sectors, there was a shared focus on growing capabilities and controls, while keeping teams moving quickly.

“Finance roles are transforming rapidly, and we're seeing AI shift from something exploratory to something embedded across core processes. The teams realising the most value are those with solid foundations in place - a modern tech stack, clean data and controls, and a culture that supports learning and innovation,” said Hauenstein.

We’ll be hosting more of these small, practical conversations in your capital city over the coming months. If you’d like to take part (or know someone who should), register your interest below.

To support finance teams preparing for 2026, we’ve been strengthening the core workflows where accuracy, structure and control matter most.

_01KAJD9H8MD0JF62CX9630PJQ6.jpg)

You can now enable cash withdrawals on your Weel physical cards. This gives approved businesses the flexibility to access cash at ATMs in Australia and overseas - all while keeping your existing budgets, controls and visibility intact.

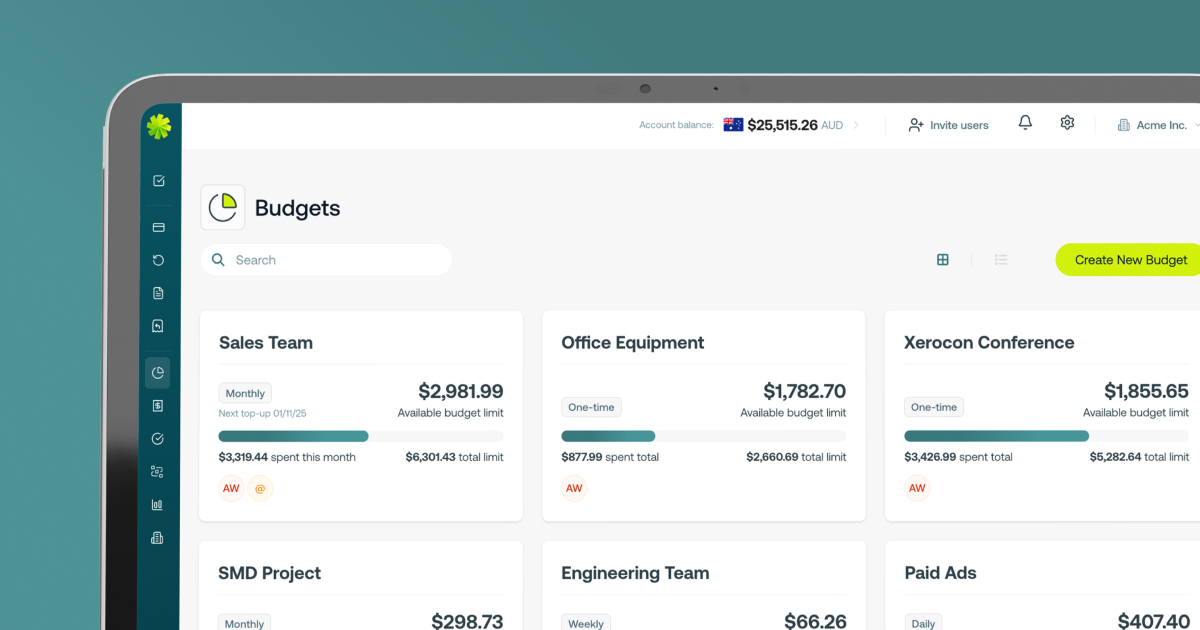

A new side nav and streamlined table make it easier to scan, compare and move between budgets, helping teams get to the right numbers faster.

_01KAFP9MVDE8SCAY0BF14X7VMS.jpg)

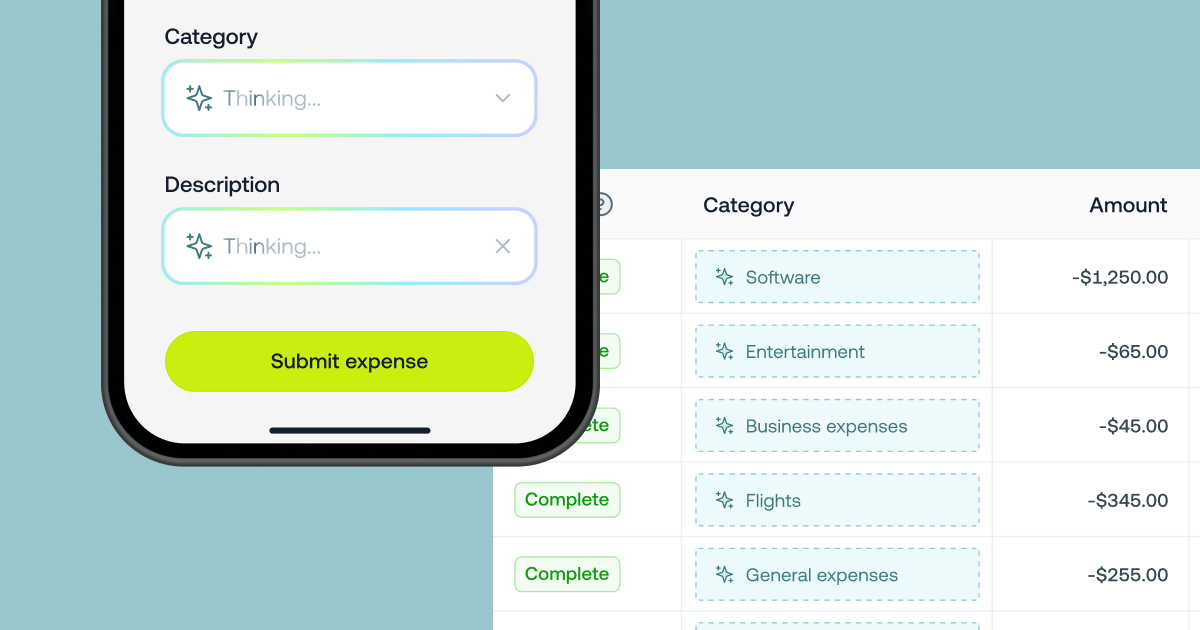

Auto-detect GST on invoices using AI, reducing manual edits and improving accuracy at month-end. Now progressively rolling out to all AU customers.

*Currently only available for Weel customers in Australia

Weel learns from past transactions and suggests the right category during review, fewer miscoded expenses, less clean-up, and a smoother close.

Fraud Awareness Week put a spotlight on just how dramatically fraud has shifted, and why finance teams need stronger, real-time controls.

The numbers:

The takeaway: Fraud is no longer just a job for the cybersecurity team; it's one that better finance workflows can help combat.

Weak approvals, loose controls and manual checks create gaps AI-driven attackers can exploit.

Finance teams using real-time visibility, structured approvals and automated safeguards are catching issues earlier and reducing exposure dramatically.

Learn more about Weel’s approach to fraud prevention

We're building Weelhouse Wire for finance teams who want an edge.

What should we keep? What should we drop? What do you want to see in next month's newsletter?

Reply directly to this email and let us know your feedback. We read every email.

Found this newsletter helpful? Forward it to a teammate and share the insights.